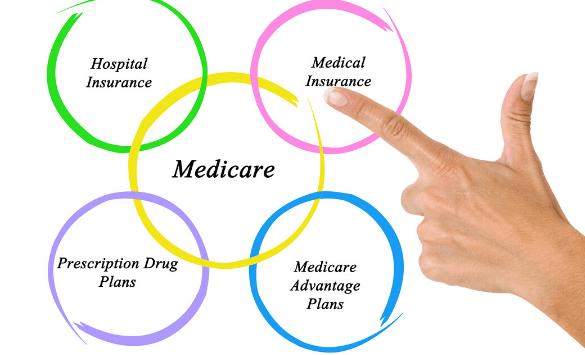

There are plenty of medical care plans that you can buy. With such a considerable plan, you might get confused about which one to choose. In such a case, there are so many things that you should consider before buying a Medicare plan. If the Medicare plan you are selecting satisfies all the things, you can consider buying that particular plan.

Now, if we talk about what are the things that we need to consider. Then the answer would be it varies from person to person according to their needs. Every person has different needs for which they buy a Medicare plan. Some people need drug coverage in that case, thereby Medicare Plan D. while other needs a Medigap plan for which day by Medicare Plan G. but still there are some factors that you should consider before buying any of the Medicare plans:

The coverage they are providing

The first thing that you should ask your insurance company is regarding the coverage. You should know what the expenses are that are covered by these plans. It is necessary because many people buy the plans without having proper knowledge of this plan. This does not make any sense to buy a Medicare plan because, in this case, you will not be able to get the benefit of this plan on time.

Cost of the plan

After the coverage, the next thing you are required to ask from the company is the cost you have to pay. Here, the cost refers to the premium that we need to pay annually to avail these plans’ benefits. However, the annual charges of the plans depend upon the age at which you are buying these plans. Still, some companies are charging more premium and other costs than the other companies. Therefore, if you compare different companies, you can get a better deal at a lower price.

Traveling expenses

Some Medicare plans provide you the coverage of traveling expenses that you occur. The original Medicare plan never provided you these expenses. If you are buying a Medicare plan for this coverage, you should go with Medicare plan G. This plan provides you the coverage of up to 80% of the expenses you encounter. All the traditional Medicare plans do not cover any expenses if you are traveling out of the country for treatment. They will provide you the coverage only if you are having treatment within the country.

So these are some basic questions that you should ask before buying a Medicare plan. It is also imperative that you should know every aspect of the plant that you are buying. So that whenever you need help with these plans, you can avail all the benefits that you are getting from this plan. There are so many people out there that are buying these plants without knowing. So stop buying this plan if you have to pay a premium and do not want to avail the benefits.